In our regular discussions with our cooperation partner Robert Half, we take a look at current developments on the labour market for accountants.

The latest assessment makes it clear that the golden age of the labour market is over - employers are now making more targeted choices, focusing on the 'perfect match' and paying more attention to practical and software skills.

Read here what this means for career starters and experienced accountants and how to position yourself optimally now.

(Source of information: Interview/market assessment, as at Aug 2025)

Just a few years ago, many skilled workers in the Financial accounting choose their job almost freely. Today, the market has clearly shifted towards Employer market postponed:

Companies are making more targeted choices, practical maturity and soft skills count more than pure theory. (Partner-Insight Robert Half)

As a result of insolvencies and reorganisations, there are more qualified profiles to choose from - the Perfect Match decides. Practical experience with common tools (DATEV, Lexware), diligence, speed and team communication are tangible selection criteria.

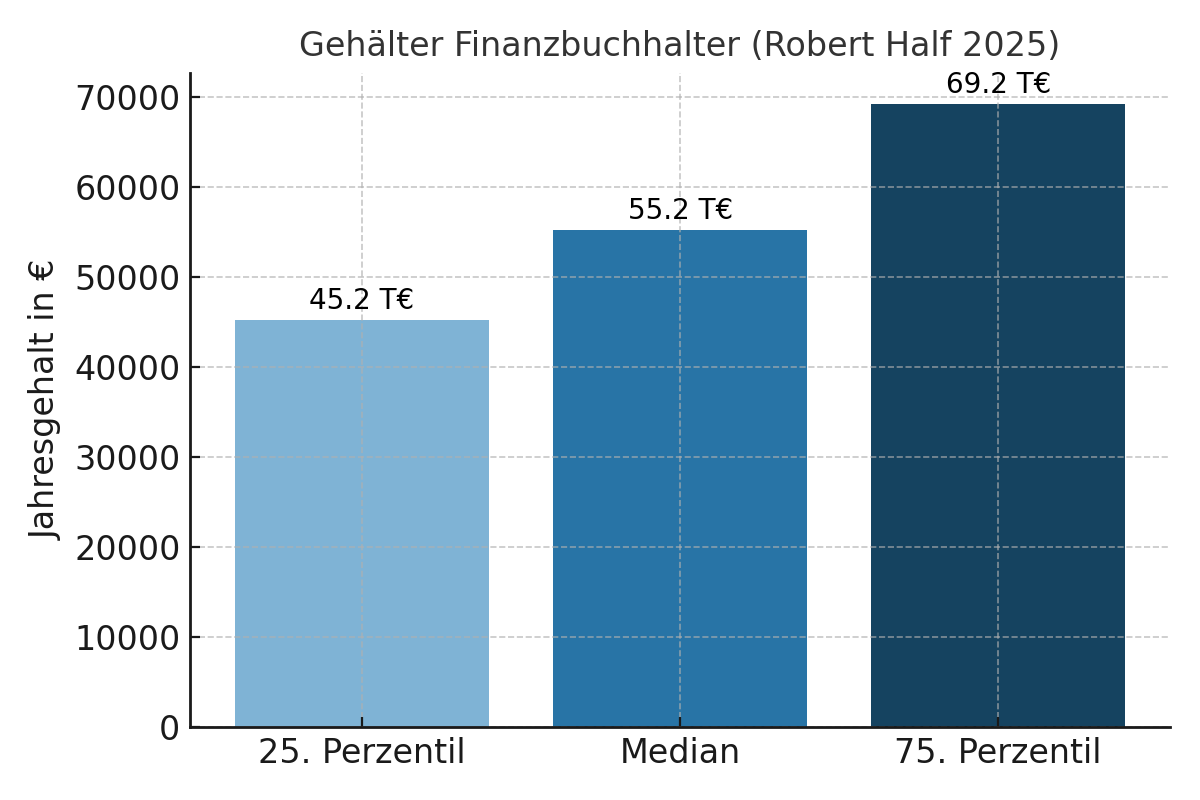

This is underpinned by current salary and recruitment overviews.

Working from home remains much more common than in 2019, but many companies are reducing purely remote models and expect several days of presence.

Destatis indicates 24,1 % Home office use in 2024 from (2019: 12,9 %).

Source: Federal Statistical Office (Destatis), "Employed persons working from home" (retrieval 2025).

Derivation: €39.6k p.a. (StepStone median accountant:in) roughly corresponds to ~€19/h at 40 hrs/week; RF median financial accountant €55.25k ≈ ~€27/h; upper quartile ~€69.25k ≈ ~€33/h. Real rates vary by region (e.g. Berlin vs. Munich), company size and responsibility.

Our experience shows that qualified candidates from abroad are particularly suitable for many companies if at least C1 German (B2 is often not sufficient for everyday communication, task allocation and problem solving.

Our Complete training combines theory (Financial accounting from A-Z), DATEV/Lexware practice and a Online accounting internship. Optional: Coaching on application, interview & salary argumentation as well as (if required) "Accounting German" as an add-on in the direction of C1.